Offshore Trust Reporting Obligations and Legal Compliance

Offshore Trust Reporting Obligations and Legal Compliance

Blog Article

The Function of an Offshore Depend On in Effective Estate Planning Methods

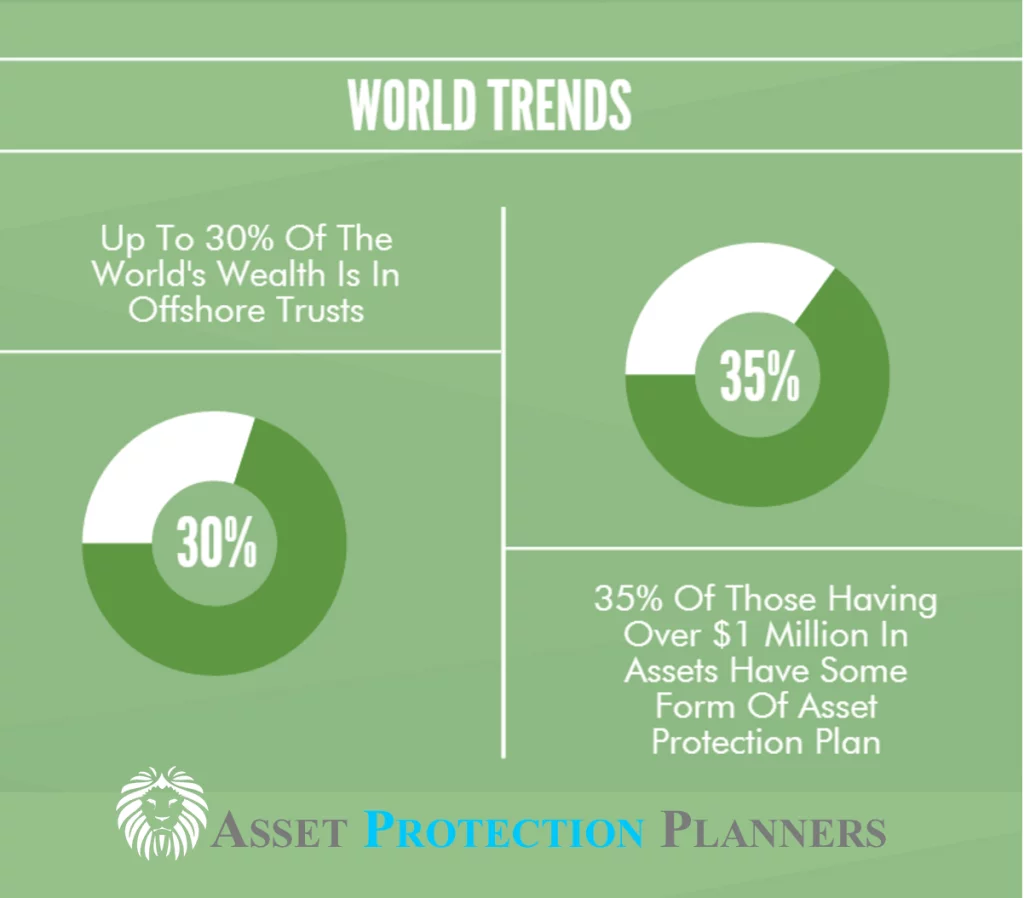

Offshore counts on are significantly recognized as a vital part of reliable estate planning techniques. They provide distinct benefits such as asset security, tax advantages, and improved privacy. By separating possession from control, individuals can protect their riches from lawful difficulties and prospective creditors. However, the complexities bordering overseas depends on can question regarding their application and effectiveness. Discovering these complexities exposes understandings that could meaningfully influence one's monetary legacy

Recognizing Offshore Trusts: A Comprehensive Overview

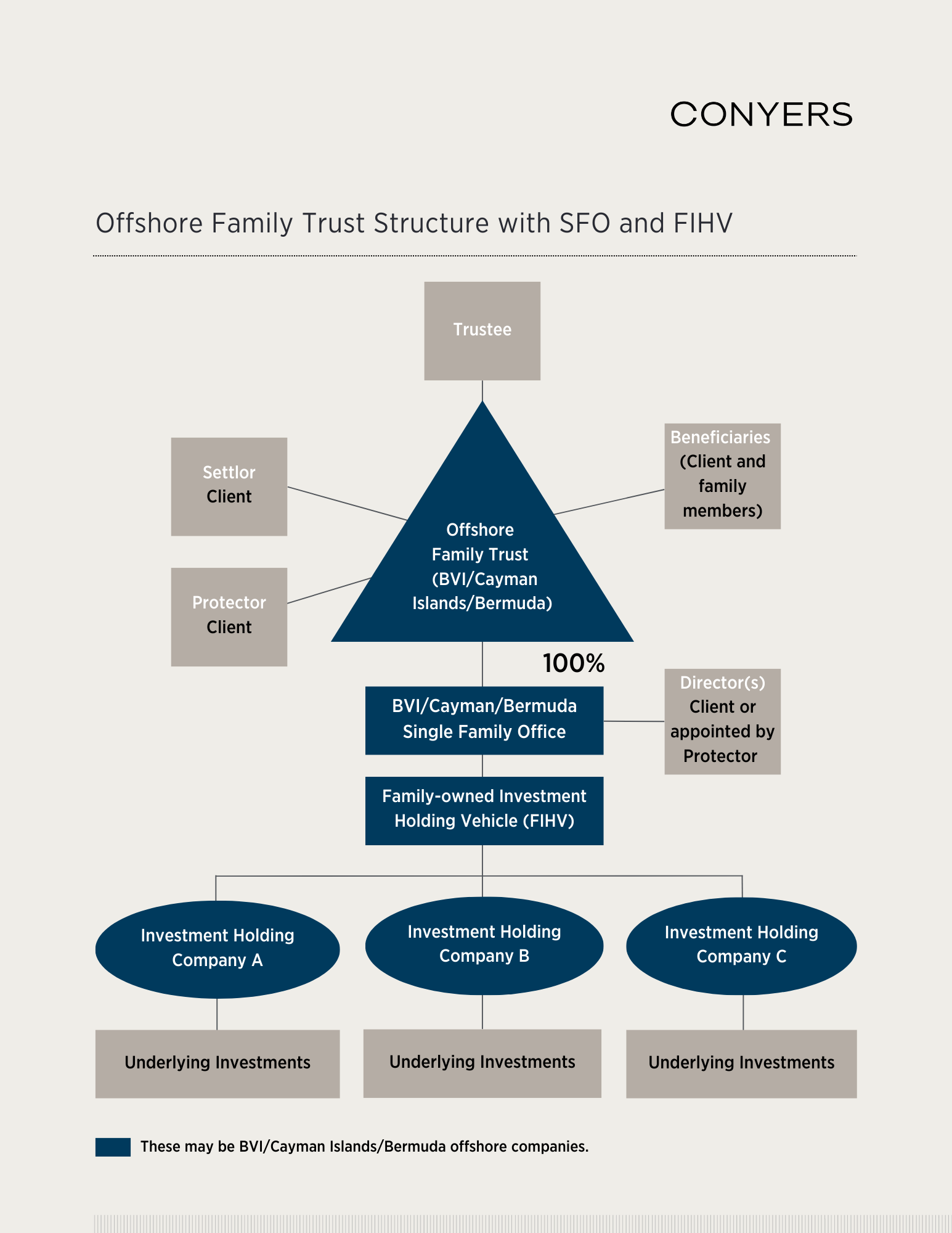

Offshore trust funds work as strategic monetary tools in estate planning, developed to protect properties and offer tax benefits. These trusts are developed in jurisdictions outside the settlor's home nation, typically featuring favorable lawful structures. Typically, people use offshore depend secure wide range from political instability, economic recessions, or potential lawsuits.The core framework of an offshore trust fund entails a settlor, that creates the trust; a trustee, in charge of taking care of the assets; and recipients, that take advantage of the count on's possessions. This splitting up of ownership and control can boost possession security, making it extra difficult for financial institutions to claim those assets.Additionally, offshore trust funds can help with estate preparation by making certain a smooth transfer of wide range throughout generations. They provide flexibility concerning possession management and distribution, allowing the settlor to customize the count on according to personal desires and family members needs. This modification is crucial for long-lasting economic security and household heritage.

The Tax Advantages of Offshore Trusts

Offshore depends on offer significant tax advantages, mainly with tax deferral advantages that can improve riches conservation. By tactically placing assets in territories with beneficial tax obligation legislations, individuals can effectively shield their riches from higher taxes (Offshore Trust). Additionally, these trust funds function as a robust property defense technique, guarding assets from financial institutions and lawful insurance claims while maximizing tax obligation effectiveness

Tax Deferral Advantages

Often overlooked, the tax obligation deferral benefits of trusts established in foreign jurisdictions can play a vital role in estate planning. These counts on frequently enable people to defer tax obligations on revenue created by the depend on assets, which can bring about considerable boosts in wide range accumulation in time. By holding off tax obligation obligations, customers can reinvest revenues, improving their total monetary growth. Furthermore, the details tax obligation policies of various overseas jurisdictions might give possibilities for further tax optimization. This calculated advantage enables individuals to straighten their estate intending goals with long-term monetary goals. Ultimately, understanding and leveraging the tax deferral benefits of offshore trusts can substantially improve the performance of an estate plan, making certain that riches is preserved and made best use of for future generations.

Property Protection Approaches

Tax obligation benefits are simply one facet of the advantages that offshore trust funds can offer in estate preparation. These counts on work as robust property protection techniques, shielding assets from prospective creditors and lawful cases. By moving assets right into an offshore depend on, people can produce an obstacle that complicates financial institutions' accessibility to those assets. This is especially useful in territories with positive count on laws, offering an extra layer of protection. Furthermore, overseas trusts can guard riches versus unanticipated situations, such as lawsuits or separation settlements. They additionally allow people to keep control over their assets while guaranteeing they are protected from exterior hazards. Inevitably, the critical use of overseas trust funds can enhance both monetary safety and estate preparation efficiency.

Possession Defense: Guarding Your Wealth

Privacy and Confidentiality in Financial Matters

In the domain of estate planning, keeping privacy and discretion is a considerable problem for lots of individuals. Offshore depends on offer as a powerful tool to accomplish these objectives, as they can effectively shield monetary affairs from public examination. By placing possessions in an overseas depend on, people can lessen the threat of unwanted exposure to their wealth and financial strategies.The fundamental attributes of overseas trust funds, such as stringent privacy laws and guidelines in particular territories, improve privacy. This implies that details pertaining to the trust's recipients and properties are usually maintained out of public records, securing delicate information.Moreover, using an offshore trust can aid minimize threats connected with possible lawful disagreements or lender cases, further promoting monetary personal privacy. In general, the strategic execution of overseas counts on can considerably strengthen an individual's monetary confidentiality, permitting them to manage their estate in a very discreet fashion.

Choosing the Right Jurisdiction for Your Offshore Trust fund

When considering the ideal territory Discover More for an offshore count on, what variables should be focused on? The legal framework of the territory is vital. This includes the trust fund regulations, possession defense statutes, and the total stability of the legal system. A territory with well-defined guidelines can supply boosted safety and enforceability of the trust.Another vital factor to consider is tax implications. Territories vary substantially in their tax therapy of overseas counts on, which can impact the overall effectiveness of the estate preparation strategy. Furthermore, a favorable regulative environment that promotes personal privacy and confidentiality must be analyzed, as this is usually an essential inspiration for establishing an offshore trust.Finally, ease of access and management requirements are necessary. Territories with efficient processes and specialist services can assist in simpler monitoring of the count on, ensuring that it satisfies the grantor's goals and sticks to conformity needs.

Usual False Impressions Concerning Offshore Trusts

What are the widespread misunderstandings bordering overseas counts on? Several individuals incorrectly think that overseas trust funds are only for the ultra-wealthy, assuming they are exclusively tools for tax evasion. In truth, offshore counts on can offer a diverse array of estate preparation requires, profiting people of numerous financial backgrounds. One more usual false impression is that these counts on are underhanded or illegal; nevertheless, when established and taken care of effectively, they follow international laws and policies. Additionally, some people fear that overseas trust funds do not have protection from creditors, but certain territories use robust legal safeguards. There is additionally a belief that taking care of an overseas trust is pricey and excessively complex, which can deter possible users. In reality, with correct assistance, developing and preserving an overseas count on can be extra straightforward than get redirected here prepared for. Dealing with these false impressions is essential for individuals thinking about overseas trusts as component of their estate planning strategy.

Steps to Developing an Offshore Count On for Estate Planning

Developing an overseas count on for estate planning involves several critical steps. Initially, individuals have to pick an appropriate territory that straightens with their lawful and financial goals. Next, choosing the appropriate trust properties and preparing a detailed trust fund file are vital to ensure the depend on operates effectively.

Picking the Jurisdiction

Choosing the appropriate territory for an offshore count on is vital, as it can substantially affect the count on's performance and the protections it offers. Aspects such as political security, lawful structure, and tax guidelines need to be diligently evaluated. Jurisdictions known for solid possession security regulations, like the Chef Islands or Nevis, are commonly favored. Furthermore, the simplicity of establishing and preserving the count on is crucial; some regions provide structured processes and less bureaucratic obstacles. Ease of access to neighborhood lawful knowledge can additionally impact the decision. Ultimately, the selected territory should align with the grantor's particular goals, making sure maximum benefits while decreasing risks related to administrative constraints or regulatory modifications.

Choose Depend On Possessions

Selecting the appropriate properties to position in an overseas trust is an essential step in the estate planning procedure. People must thoroughly examine their properties, consisting of cash, financial investments, realty, and business passions, to identify which are ideal for incorporation. This evaluation must consider aspects such as liquidity, potential development, and tax implications. Diversification of possessions can enhance the depend on's stability and guarantee it fulfills the beneficiaries' requirements. Furthermore, it is vital to account for any legal restrictions or tax obligations that may emerge from transferring specific properties to the overseas count on. Eventually, a well-balanced selection of count on properties can significantly impact the performance of the estate strategy and safeguard the customer's want possession circulation.

Composing the Trust File

Preparing the trust record is a crucial action in the creation of an offshore depend on for estate planning. This paper lays out the details terms under which the trust operates, outlining the functions of the trustee, recipients, and the circulation of properties. It is very important to plainly define the function of the count on and any kind of terms that may apply. Legal needs may differ by territory, so seeking advice from an attorney experienced in offshore counts on is important. The record must likewise deal with tax effects and possession security methods. Appropriately implemented, it not only safeguards web link assets yet likewise assures conformity with international laws, ultimately facilitating smoother estate transfers and lessening possible conflicts among beneficiaries.

Regularly Asked Concerns

How Do Offshore Trusts Affect Probate Processes in My Home Nation?

Offshore trust funds can significantly affect probate processes by possibly bypassing regional administrative legislations. They may shield possessions from probate, reduce tax obligations, and enhance the transfer of riches, ultimately causing an extra reliable estate negotiation.

Can I Be a Recipient of My Very Own Offshore Count on?

The inquiry of whether one can be a recipient of their very own offshore trust fund usually develops. Typically, people can be named recipients, yet details guidelines and ramifications may vary depending on territory and count on framework.

What Happens if I Relocate to Another Nation After Developing an Offshore Trust Fund?

If a specific steps to another nation after developing an offshore trust fund, they might deal with differing tax obligation ramifications and legal laws, potentially affecting the trust fund's monitoring, distributions, and reporting commitments according to the brand-new jurisdiction's laws.

Are Offshore Trust Funds Ideal for Tiny Estates?

Offshore depends on might not be suitable for tiny estates because of high arrangement and maintenance expenses. They are generally more useful for larger properties, where tax advantages and property protection can justify the expenditures involved.

What Are the Expenses Linked With Maintaining an Offshore Depend On?

The expenses related to keeping an overseas depend on commonly consist of legal charges, management expenses, tax compliance, and possible trustee costs. These costs can vary substantially based on the complexity and jurisdiction of the depend on. Commonly, individuals utilize offshore depends on to safeguard riches from political instability, economic slumps, or potential lawsuits.The core framework of an offshore depend on includes a settlor, that produces the count on; a trustee, responsible for taking care of the possessions; and recipients, that benefit from the trust's properties. By positioning wide range within an overseas trust fund, people can safeguard their possessions versus suits, divorce negotiations, and other unanticipated liabilities.Offshore trusts are normally regulated by the legislations of jurisdictions with beneficial property protection regulations, offering boosted security contrasted to residential options. By placing assets in an overseas trust fund, individuals can minimize the threat of undesirable exposure to their riches and financial strategies.The fundamental attributes of overseas trust funds, such as rigorous personal privacy regulations and guidelines in specific jurisdictions, boost confidentiality. Picking the ideal jurisdiction for an overseas depend on is vital, as it can substantially influence the trust's effectiveness and the securities it offers. Drafting the depend on file is an important action in the development of an offshore depend on for estate planning.

Report this page